These are the raw materials needed to manufacture and sell your goods or merchandise. You may also see this written as Cost of Sales. Cost of goods soldĬost of Goods Sold (COGS) is a special type of expense that pertains to the cost that you, the seller, incurs to manufacture or sell an item. Remember, always request a donation receipt for your taxes, since you’ll have to include that when you claim the deduction. That means donations to your favorite political organizations are NOT tax deductible. For a donation to be tax deductible, the organization must be categorized as a 501(c)(3) non-profit. This means cash and in-kind donations you made to charity. Permits: Resale permits and permits required by government agencies can be deducted.

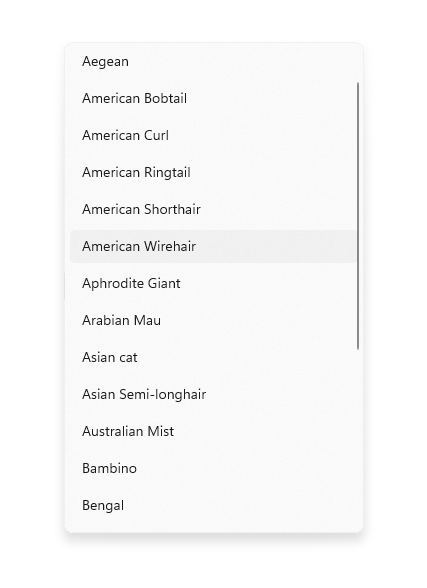

#EXAMPLE OF BOOTH SPACE DROP DOWN ITEM LIST PROFESSIONAL#

Licenses: Business licenses, alcohol resale licenses, and professional licenses required to perform your services or sell your merchandise fall into this bucket.Fortunately, the business-related fees and costs associated with acquiring those licenses and permits are deductible. Shop owners need to ensure that they have current licenses and permits to run their shops. Loan and leasing fees: This includes things like set-up costs for loans and leasing fees for equipment.Credit card fees: This includes annual fees, late payment fees, and interest.Bank fees: You can deduct monthly service fees, ATM fees, overdraft fees, deposit fees, wire transfer fees.Bank feesįees associated with your business bank accounts and loans are deductible.

Regardless of which method you choose for calculating your auto deduction, parking and tolls for business travel are 100% deductible.

And for all your purchases, save your receipts! 31 tax deductions for shop owners 1. Start by checking out this giant list of tax deductions specifically designed for small business owners with physical (as in, real-life) stores.

The more you understand them, the more business activities you can write off to lower your taxable income and pay less during tax season.īut before you can reap the benefits, you have to know what’s what. Why? Because deductions make taxes WAY more interesting and affordable. And your small business tax deductions are that person snapping up all your stellar goods.

0 kommentar(er)

0 kommentar(er)